Deadline To File S Corp Taxes 2024. To be considered an s corporation for tax purposes in 2024, existing llcs and c corporations must file their election within two months and 15 days (within 75. Is there a deadline to file for an s corp?

If you’re a c corporation or llc electing to file your taxes as one for 2023, your corporate tax return is due on april 15th, 2024—unless you. Tuesday, october 15, 2024, is the final extended deadline (for the fiscal year ending december 31, 2023) to file individual and corporate tax returns for the tax year 2023.

What Irs Tax Forms Do S Corps File?.

Here are the dates and irs forms you need to know.

Extension Requests (Using Irs Form 7004) Are Also Due On This Date.

Fiscal year corporate taxpayers must file their tax returns by the 15th day of the fourth month following the end of their tax year.

Filing For An S Corp Is Subject To Deadlines That Should Be Taken Into.

Images References :

Source: www.taxsavingspodcast.com

Source: www.taxsavingspodcast.com

What Is An S Corp?, What is the tax deadline for s corp 2024? However, corporations with a fiscal tax year.

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, Is there a deadline to file for an s corp? Filing for an s corp is subject to deadlines that should be taken into.

Source: startupsavant.com

Source: startupsavant.com

Filing S Corp Taxes 101 — How to File S Corp Taxes TRUiC, Fiscal year corporate taxpayers must file their tax returns by the 15th day of the fourth month following the end of their tax year. An s corporation is required to file its annual tax return by the 15th day of the third month following the end of the tax year,.

Source: www.artofit.org

Source: www.artofit.org

How to file s corp taxes maximize deductions Artofit, Fiscal year corporate taxpayers must file their tax returns by the 15th day of the fourth month following the end of their tax year. S corporation and partnership tax return due date for calendar.

Source: neswblogs.com

Source: neswblogs.com

Tax Extension Deadline 2022 For S Corp Latest News Update, Filing for an s corp is subject to deadlines that should be taken into. March 15, 2024 file business taxes after an extension, partnerships, llcs and s corporations using.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

S Corp Taxes The Ultimate Guide to Filing Taxes as an S Corp, Fiscal year corporate taxpayers must file their tax returns by the 15th day of the fourth month following the end of their tax year. Once the irs receives and approves the form, the corporation is taxed as an s corporation starting.

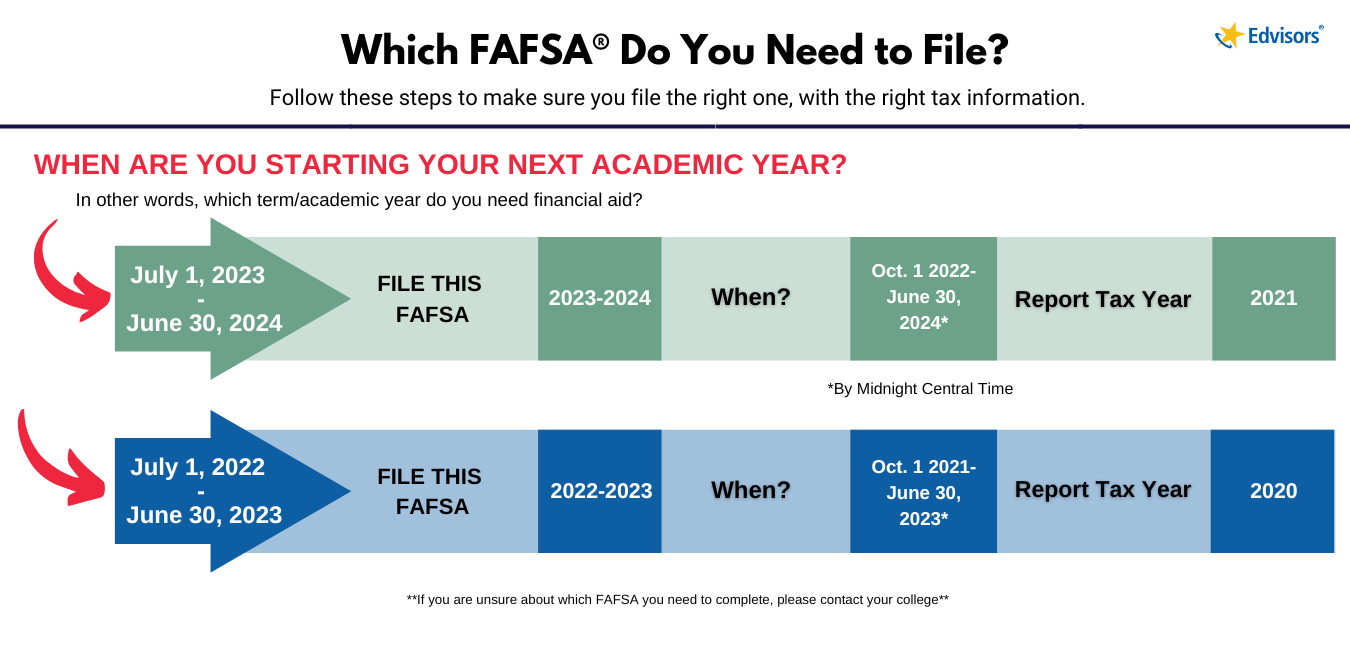

Source: marniawlina.pages.dev

Source: marniawlina.pages.dev

What Is The Deadline For Fafsa 2024 Kira Randee, Key tax deadlines are coming up in 2024 for llc and corporation businesses. Fiscal year corporate taxpayers must file their tax returns by the 15th day of the fourth month following the end of their tax year.

Source: www.artofit.org

Source: www.artofit.org

How to file s corp taxes maximize deductions Artofit, Tax deadline for s corp: Businesses that follow a fiscal year other than the calendar year have until two months and 15 days.

Source: www.artofit.org

Source: www.artofit.org

How to file s corp taxes maximize deductions Artofit, The deadline for your 1120s is march 15th. Extension requests (using irs form 7004) are also due on this date.

Source: accountingservices.sg

Source: accountingservices.sg

File Corporate Tax Returns by 30 Nov, 15 Dec Extended Deadline, Everything you need to know. The deadline for filing form 1120s is:

Businesses That Follow A Fiscal Year Other Than The Calendar Year Have Until Two Months And 15 Days.

For 2024, s corp taxes are due on march 15, 2024.

However, Corporations With A Fiscal Tax Year.

What irs tax forms do s corps file?.